Segment is Twilio’s Competitive Advantage

Understanding Twilio's acquisition of Segment, and what this means for other API companies

(Source: Twilio)

Twilio’s recently confirmed acquisition of Segment for $3.2 billion—just over 2x Segment’s most recent valuation—is exciting. Not just because of the opportunity in front of the combined business, but also, and perhaps more importantly, because this acquisition signals an important inflection point for API companies.

First, let’s define an API company: a company who develops a public API that is a core part of its product or business. Publicly available investment information on API companies is scant, even via paid services, but as far as I can tell there have only been three billion dollar acquisitions of API companies to date. And interestingly, Twilio’s acquisitions take the 2nd and 3rd spots:

Visa’s $5.3 billion acquisition of Plaid, who provides APIs for connecting and integrating your banking data with other apps

Twilio’s $3.2 billion acquisition of Segment, who has a suite of APIs for collecting and aggregating customer and business data across disparate sources

Twilio’s $2 billion acquisition of SendGrid ($3 billion by the time the deal closed), who provides an API for automating emails

When discussing billion dollar acquisitions of API companies, people also often refer to Salesforce’s $6.5 billion acquisition of MuleSoft. However, MuleSoft doesn’t develop any of its own APIs, but rather it provides a platform that makes it easier for companies to build APIs. Instead, MuleSoft is an important part of the larger API economy *, the ecosystem of companies that: 1) develop public APIs, 2) sell APIs, or 3) build the infrastructure that enables companies to do 1 or 2.

* Or what I like to call it: the pick and shovel play powering the next great wave in software (more on this in a later post).

With its recent acquisition of Segment, Twilio is cementing itself as an integral player in driving the still somewhat nascent API economy. Not only has Twilio helped prove that API companies can become some of the largest tech companies (at the time of writing this, Twilio’s market cap was $48 billion), but Twilio is also signaling with its acquisition of SendGrid and now Segment that billion dollar acquisitions are a viable exit path for API companies.

Though, it’s important not to just take the acquisition of Segment at face value without first understanding why Twilio would acquire Segment and whether $3.2 billion is a fair price for the company.

To do that, let’s first dive into Twilio’s business.

Understanding Twilio’s business

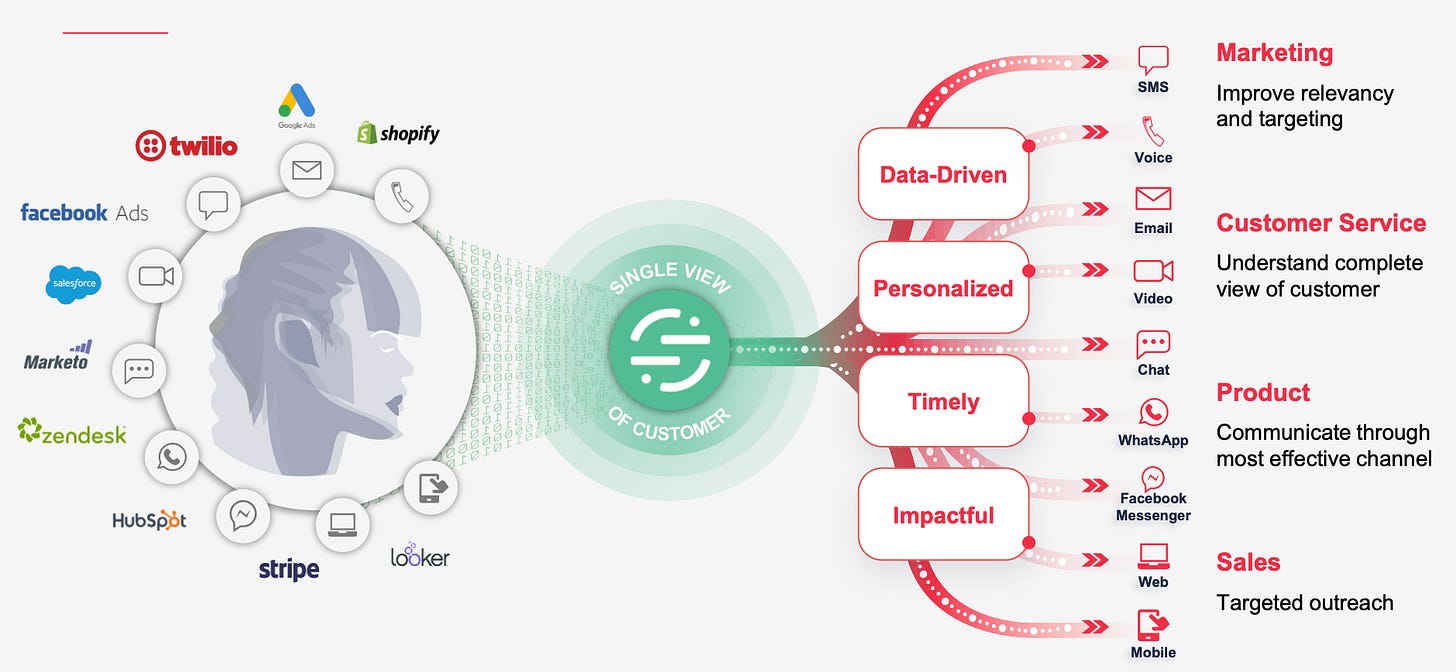

(Source: Twilio)

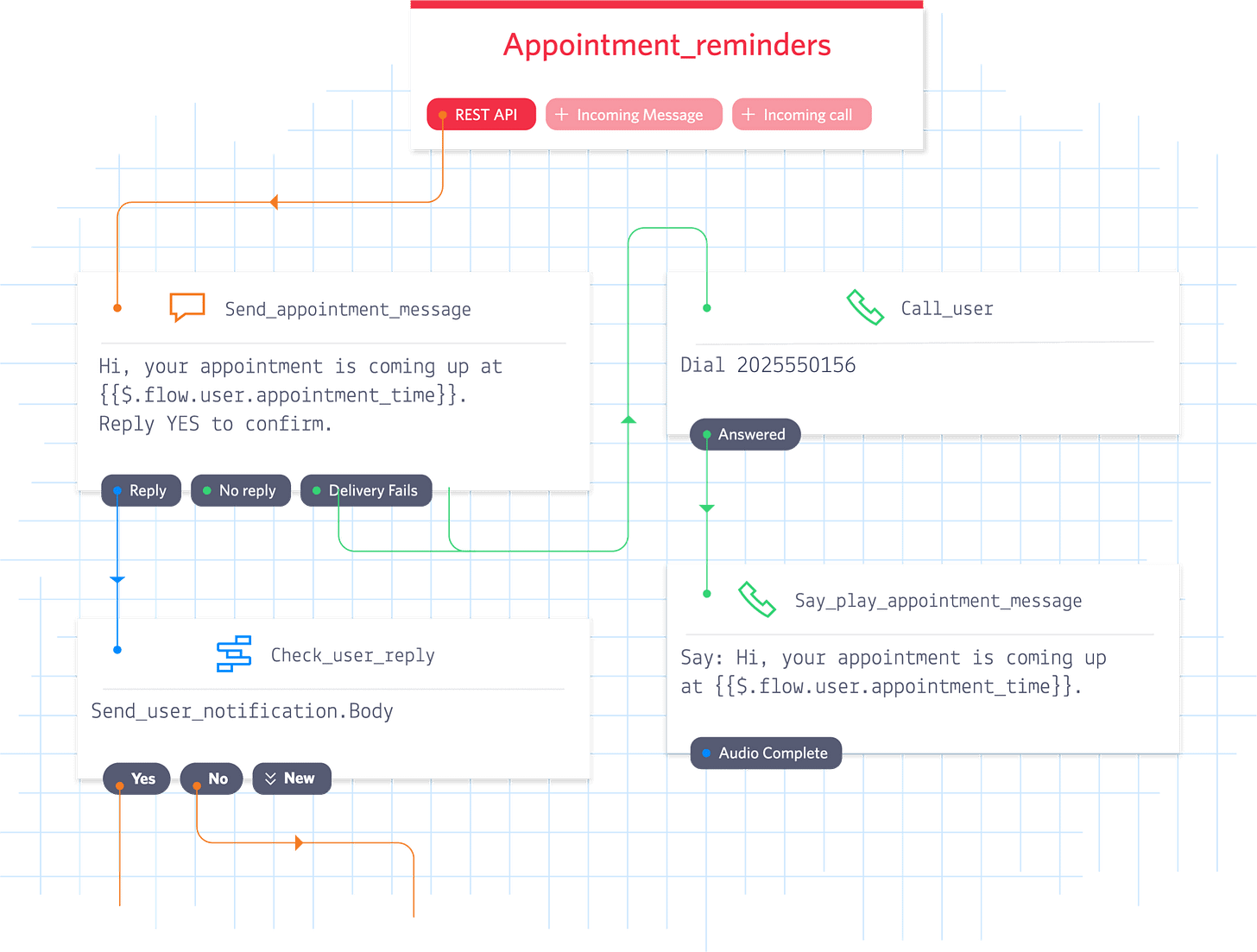

Twilio makes a suite of APIs that help businesses easily communicate with their customers across every major channel: SMS, voice, chat (e.g. Messenger, WhatsApp), email (via their acquisition of SendGrid), video, etc.

Twilio’s most popular set of APIs are the ones that help you send automated messages, everything from sending appointment reminders or confirmations, to setting up AI-powered chatbots.

Twilio also has products that help you orchestrate, organize, and track every part of a customer conversation: everything from provisioning you a phone number, to routing conversations to/from you and your customers, to visually displaying your customer conversations in a dashboard along with the analytics that pertain to them. On top of that, Twilio integrates into your existing CRM (it doesn’t directly compete with it) so that your customer service agents can see all relevant customer information during a conversation. Everything you need for your cloud contact center, as they refer to it.

Importantly, Twilio even offers a visual workflow builder (Twilio Studio), a low-code environment that allows you to use drag and drop functionality alongside some light custom code to create fully functioning applications using Twilio’s APIs. While Twilio is still a developer-first company, this product opens up its customer base to include more than just developers or even tech companies, effectively making Twilio the portal to any business’s customers.

(Source: Twilio)

Where Segment’s business fits in

(Source: Segment)

Segment’s business centers on its suite of event-driven APIs for customer data collection (i.e. Segment Connections). Whenever your customers take an action that involves your product, you can use Segment’s API to send an event confirming that action was taken.

You can set up Segment to send the data it collects to two types of destinations:

Your database or data warehouse of choice: This allows you to later query this data to better understand your customers

To a 3rd party integration (e.g. Google Analytics, Intercom, Facebook Ads, Customer.io): This allows you to trigger specific follow-up workflows or customer interactions based on the data Segment has collected

Segment allows you to intimately understand who your customers are, how they’re using your product, and when they’re using your product. On top of that, you can use the insight that Segment helps you gather to then drive the way in which you interact with your customers going forward—meaning, with Segment, you can make your customer interactions smarter and data-driven based on how your customers’ usage of your product evolves over time. Said another way: with Segment, Twilio’s products can get better and much more personalized to each of its customers’ users, especially with increased usage and scale. And in fact, reading Jeff Lawson (the CEO of Twilio)’s blog post announcing the acquisition, he mentions the word “personalization” 3 times.

For a company like Twilio that delivers omnichannel customer communications, what Segment can provide is critical because the true value of customer communications is in how effective they are. With this acquisition, Twilio will finally be able to differentiate its value proposition and make its business much more defensible.

Making Twilio’s business defensible

Currently, Twilio’s primary value-add is in its economies of scale. As with many companies, the functionality Twilio offers, especially its core SMS and messaging products, isn’t revolutionary or unreproducible. Instead of choosing to use Twilio’s products, most large tech companies could theoretically choose to build Twilio’s functionality in-house, and thereby cut them out completely. It would just be a lot more expensive if they did, in terms of both money and engineering time. So even large tech companies continue to outsource to Twilio.

At Twilio’s scale—which in large part is a function of good market timing—it can negotiate huge discounts with its vendors based on the volumes across its entire customer base. Twilio can then pass on some of these cost savings to its customers, making it much less appealing for any company to choose to build instead of buy from Twilio. However, while Twilio’s economies of scale do well to fend off the perennial “buy vs build” decision from its prospective customers, they simply aren’t enough of a moat to thwart competitive threats. And we are starting to see companies with large amounts of capital, both in the US and abroad, start to encroach on Twilio’s domain: Vonage (with their acquisition of Nextmo), Microsoft's Azure Communications Service, and even the newly minted Dutch unicorn MessageBird (who appears to have lured Uber as a customer away from Twilio).

But that’s where Segment comes in. With Segment, Twilio is now able to do two things natively across it’s platform:

Measure and prove it’s value to businesses: By being able to connect a business’s Twilio data with all of their other customer data, Segment enables Twilio’s customers to measure and prove the impact of Twilio-enabled communications to their business. Twilio and Segment have had an integration for some time now, and some of the example questions this integration helps businesses answer aren’t possible with just Twilio’s products alone. Questions like: How often do customers log back into your app after getting a text message? Do customers that contact delivery drivers spend more money over time? With this acquisition, Twilio can now bake Segment’s data insights directly into their product

Make its automated customer interactions smarter: Eventually, Segment will be able to help Twilio’s customers use the data it collects to automatically rebalance its communications to the channels that are most effective for each user, and to better tune the content of its communications so that it is more personalized to the profile of each user, and thus more effective.

In Jeff Lawson’s own words:

“A combined Twilio and Segment means Twilio can help any business make their customer engagement across every channel more personalized, timely and impactful.”

“Over time, the addition of Segment will allow Twilio to integrate data intelligence into Twilio Flex and every one of our offerings to provide highly personalized customer touchpoints.”

In short, Twilio just acquired a company that can exponentially compound the effectiveness and stickiness of its product over time.

Segment’s value to Twilio is not just in the data it gives businesses access to, but also in the insights that can be derived on top—this is what creates a flywheel that feeds back into improving and increasing the value of Twilio’s products.

The combined business of Twilio and Segment allow them both to build more defensible businesses in each of their market segments that make the “buy vs build” decision a lot clearer for their prospective customers. And in fact, Twilio reports that over 88% ($15 billion) of Segment’s Total Addressable Market (“TAM”) is attributable to DIY software tools used for data integration. This is a pretty sizable new market opportunity that just opened up for the combined business.

But importantly, this acquisition also makes it harder for competitors in either of Twilio’s or Segment’s respective industries to form a real threat. Especially with increasingly formidable competitors now seriously encroaching on Twilio, a competitive advantage based on a data insights layer seems intrinsic.

And if Twilio continues to double down on offering low-code ways to interact with its APIs, it can continue to build a moat that is harder to take down, while increasing its potential TAM and customer base. Or if Twilio doesn’t, given the burgeoning rise of low-code and no-code startups in the API economy, someone else likely will.

Now, weighing the value of Segment relative to its price tag of $3.2 billion, which is estimated to be ~17-21x Segment’s annualized revenue:

Revenue Growth: Segment’s revenue is growing at 50%+ annually

Gross Margins: Segment has ~75% gross margins

Segment’s revenue growth and gross margins are both healthy and also higher than the respective median metrics of public SaaS companies—in fact, Segment’s revenue growth is nearly double the median revenue growth of public SaaS companies. On top of that, the median revenue multiple of public SaaS companies is ~17.4x revenue. Twilio paying 17-21x revenue for Segment not only seems logical, but it also seems like a great deal.

As the API economy continues to mature, it’s clear that Twilio will be the company to watch. It continues to prove that public APIs can drive real enterprise value for businesses and valid multi-billion dollar exits.

As more non-SaaS companies begin to offer their own APIs and developer platforms (again, more on this in a later post), Twilio’s acquisition of Segment may also provide us with a new framework for thinking about how to value non-SaaS companies.

Great writeup, thanks.